Mortgage Rates 2024

“You come to us for the rate, you’ll be back for the service!”™

Date updated: January 26, 2024

| Term | Posted Bank Rates | Homefund Best Rates |

|---|---|---|

| 6 months | 7.84% | 7.55% |

| 1 year | 7.84% | 6.64 – 7.04% |

| 2 year | 7.34% | 5.99 – 6.37% |

| 3 year | 6.94% | 5.19 – 5.49% |

| 4 year | 6.74% | 5.14 – 5.49% |

| 5 year | 6.79% | 5.04 – 5.49% |

| 5 year Variable Rate | 7.20% | 6.20% – 6.70% |

| 6 year | 6.99% | 6.34% |

| 7 year | 7.00% | 5.65 – 6.05% |

| 10 year | 7.25% | 6.05 – 6.45% |

| Secured Line of Credit | Prime + 1.00% | Prime + 0.50% |

Rates are subject to change at any time without notice. Contact our office for other mortgage products. Rates based on Prime Residential. No Fees For Qualified Applicants.

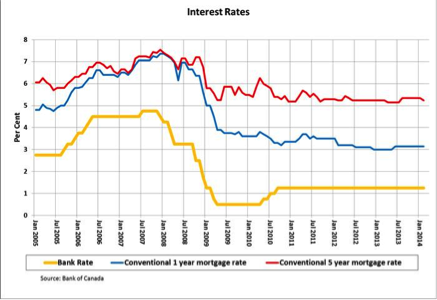

Historical Rates in Canada

This chart has tabulated the conventional mortgage since 2005 for 1 and 5 years fixed rates, along with the Bank of Canada overnight lending rate. The rates charted are Bank Posted Rates, but actual approved rates are typically discounted. A study conducted on behalf of CAAMP estimates that the average discount on a 5 year mortgage was 1.40% below the Bank Posted 5 year fixed rate.

Fixed vs Variable Rate Mortgages

One of the more important decisions right from the start is choosing a fixed rate or variable rate mortgage term. Economists provide predictions, and for over 20 years at Homefund we have seen them being off the mark. So how do you decide with confidence? Homefund Mortgage Specialists can’t predict the future, so we examine and remove as much risk as possible. We analyze mortgage rate trends, mortgage conditions and other mortgage variables to provide you with the right guidance.

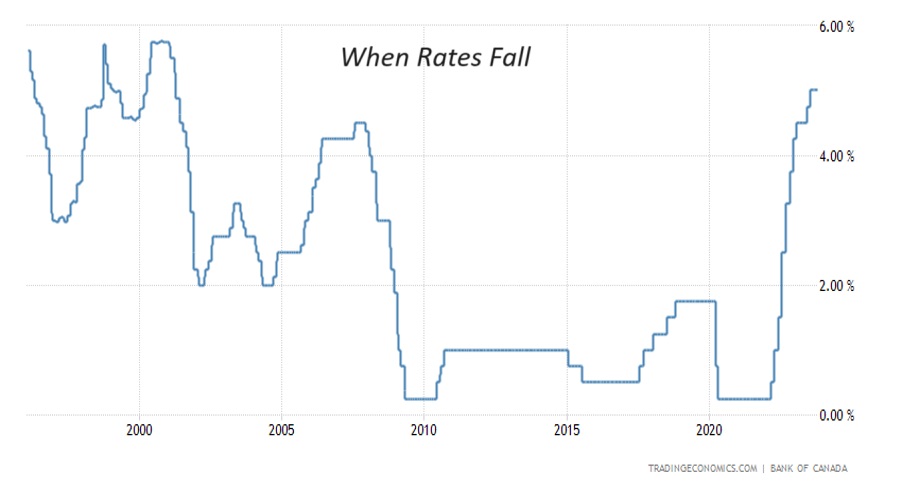

January 24, 2024 Bank of Canada Announcement

As was widely anticipated by markets, the Bank of Canada held its overnight target rate at 5.00%, where it has been since July 2023.

Aside from the expected rate hold, markets focused on several dovish signals from the central bank, including the absence of its previously used line that it remains prepared to raise the policy rate further if needed.

And during a press conference following the announcement, Bank of Canada Governor Tiff Macklem confirmed that there was a clear consensus to maintain our policy at 5%, and that the deliberations shifted from whether monetary policy is restrictive enough to how long to maintain the current restrictive stance.

While the Bank is not yet ready to signal a change in policy, markets are taking the lead. Odds are pointing to the first rate cut happening in April/June. We echo this sentiment.

He points to a flatlining of the economy since the summer and a return of the job market back to balance. Even the B of C quantitative tightening policy looks to have potentially gone too far with market overnight rates continuing to drift from the Bank’s target rate, he added.

Bond markets continue to price in 33% odds of a quarter-point rate cut as early as March, and 55% odds of a 50-bps rate cut by June. The B of C still remains concerned about inflation expectations. However, the Bank made clear that it remains concerned about the inflation outlook and the persistence of underlying inflation. Governing Council wants to see further and sustained easing in core inflation, it said. In its latest inflation outlook, the Bank maintains that headline inflation won’t return to its desired 2% target until 2025. It said that due to strong wage growth of 4% to 5%, core measures of inflation are not showing sustained declines.

Bank of Canada acknowledges problematic shelter costs.

For the first time, the Bank also referenced the impact of high shelter costs, which it noted are the biggest contributors to above-target inflation.

Despite consumers cutting back on spending over the past year, which would typically lead to a more rapid deceleration in inflation, Orlando noted that structural imbalances in the real estate sector are keeping the B of C preferred inflation gauges elevated.

- Wednesday, January 24*

- Wednesday, March 6.

- Wednesday, April 10*

- Wednesday, June 5.

- Wednesday, July 24*

- Wednesday, September 4.

- Wednesday, October 23*

- Wednesday, December 11.

Rates are subject to change at any time without notice. Contact our office for other mortgage products. Rates based on Prime Residential. No Fees For Qualified Applicants.