Mortgage Rates 2025

“You come to us for the rate, you’ll be back for the service!”™

Date updated: November 15, 2025

| Term | Posted Bank Rates | Homefund Best Rates |

|---|---|---|

| 6 months | 6.09% | 5.99% |

| 1 year | 5.84% | 5.24 – 5.39% |

| 2 year | 5.14% | 4.49 – 4.54% |

| 3 year | 6.05% | 3.89 – 4.19% |

| 4 year | 5.99% | 4.14 – 4.39% |

| 5 year | 6.09% | 3.99 – 4.29% |

| 5 year Variable Rate | 4.09% | 3.60% – 4.04% |

| 6 year | 6.29% | 5.09 – 5.29% |

| 7 year | 6.40% | 5.14 – 5.34% |

| 10 year | 6.80% | 5.24 – 5.44% |

| Secured Line of Credit | Prime + 1.00% | Prime + 0.50% |

Rates are subject to change at any time without notice. Current Chartered Bank Prime Rate is 4.45%. Contact our office for other mortgage products. Rates based on Prime Residential. No Fees For Qualified Applicants.

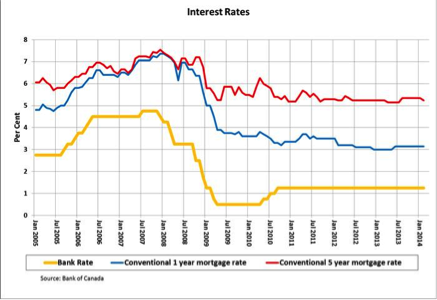

Historical Rates in Canada

This chart has tabulated the conventional mortgage since 2005 for 1 and 5 years fixed rates, along with the Bank of Canada overnight lending rate. The rates charted are Bank Posted Rates, but actual approved rates are typically discounted. A study conducted on behalf of CAAMP estimates that the average discount on a 5 year mortgage was 1.40% below the Bank Posted 5 year fixed rate.

Fixed vs Variable Rate Mortgages

One of the more important decisions right from the start is choosing a fixed rate or variable rate mortgage term. Economists provide predictions, and for over 20 years at Homefund we have seen them being off the mark. So how do you decide with confidence? Homefund Mortgage Specialists can’t predict the future, so we examine and remove as much risk as possible. We analyze mortgage rate trends, mortgage conditions and other mortgage variables to provide you with the right guidance.

Fixed-Rate Advantage Over To Variable Continues To Narrow

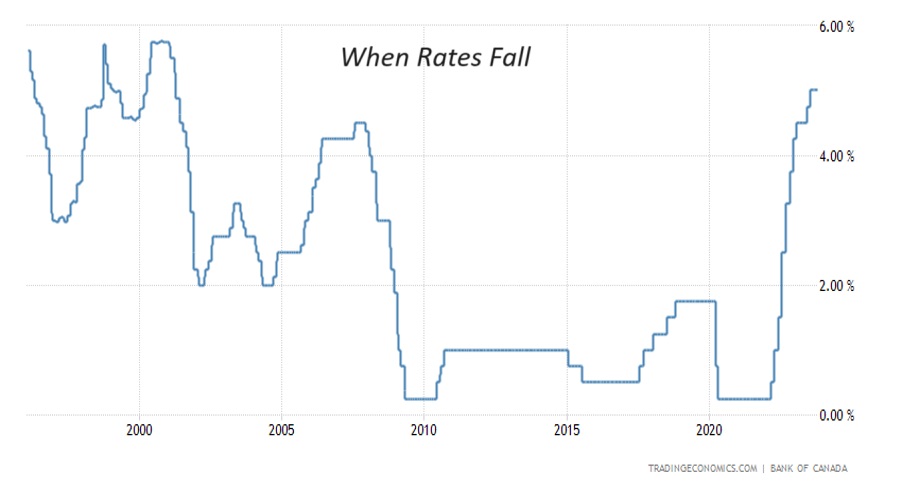

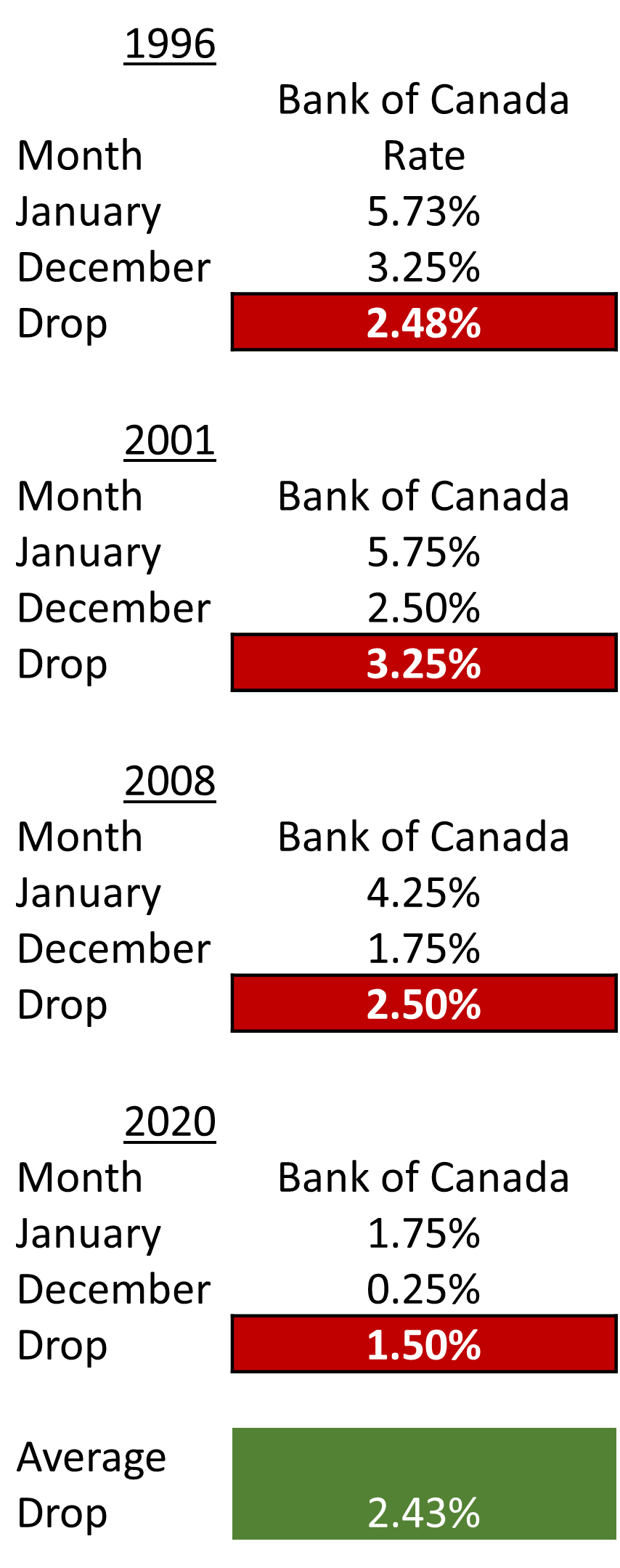

The central bank’s five rate reductions in 2024 mean the gap between fixed and variable has been steadily whittled away, although fixed rates have also slipped since June and are projected to tick down further in 2025.

But the Bank of Canada has made little secret of the fact that it expects to continue trimming its benchmark rate amid a darkening economic outlook and uncertainty about the looming prospect of tariffs from the incoming US administration.

Governor Tiff Macklem said after the Bank’s latest rate cut that US president-elect Donald Trump’s plans for a 25% tariff on all Canadian goods entering the country were “highly disruptive” and “a major source of uncertainty” as 2025 comes into view.

Those would “have a big impact on the Canadian economy and… dramatically impact our forecast,” Macklem said last week.

The central bank’s former deputy governor Paul Beaudry said last week that he believes policymakers will continue cutting until the key interest rate drops to 3.75%.

- Wednesday, January 29.

- Wednesday, March 12.

- Wednesday, April 16.

- Wednesday, June 4.

- Wednesday, July 30.

- Wednesday, September 17.

- Wednesday, October 29.

- Wednesday, December 10.

Rates are subject to change at any time without notice. Contact our office for other mortgage products. Rates based on Prime Residential. No Fees For Qualified Applicants.